31 Mar Client Centric vs. Vendor Centric Project Management

Where Does Value Come From?

Everyone wants more value when purchasing a service—the highest quality for the lowest price possible. The big question is how do you ensure that you get the most value from your purchase? To do this, you first must know where value comes from. There was a time when it was obvious who created the value for a service. However, as business processes have become more complicated, many people have become confused and no longer know where the value comes from.

Everyone wants more value when purchasing a service—the highest quality for the lowest price possible. The big question is how do you ensure that you get the most value from your purchase? To do this, you first must know where value comes from. There was a time when it was obvious who created the value for a service. However, as business processes have become more complicated, many people have become confused and no longer know where the value comes from.

In recent years, I have heard people say that value comes from legal contracts, procurement processes, client consultants, collaboration between stakeholders, and even relationships. Although many of these things help improve project quality and lower costs, none of these things create the value.

Value comes from providing a service or product to others at a reasonable cost. If this is correct, when an organization is looking for a product or service, the most valuable entity is the expert vendor who can meet the organization’s needs. Anyone else involved in the process of getting the service detracts from the value. These people serve as extra resources required to get the service. Since they don’t add to the core value, they make the process more expensive.

If this definition is correct, then experts are the key to getting more value for a service. Unfortunately, most organizations do not understand this. When organizations don’t center their model on the expert vendor, they end up with a lower quality service, that costs more, and takes more time to deliver. Many industries are suffering from poor performance (CII, 2015; HIS Markit, 2013; Rivera, 2017):

-

- 5% of projects defined as successful (scope, cost, schedule, & business) (CII, 2015).

- Performance across IT, Construction, Medical, Aerospace and Defense, Manufacturing, and Energy have an average on time/on budget of 41%/44% with a customer satisfaction of 5.9 (out of 10) (Rivera, 2017).

- Mega-projects within construction services (projects larger than $100M USD) are 98% cost overrun and delayed, with an 80% average cost increase (HIS Markit, 2013).

Changing the System

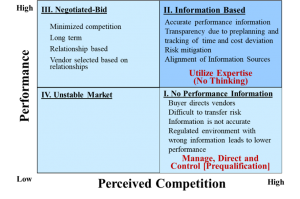

Figure 1: Industry Structure

If we want to improve project performance most organizations need to change the way they procure and deliver their projects and services. Most of the time this change involves moving from a client centric approach to a vendor centric approach. Figure 1 on the right is the industry structure (IS) diagram. It divides the industry into four segments. Most organizations like to be on the right side where competition is high, because it usually brings down the cost. The IS identifies the only way to move from a low performing service to a higher performing (higher quality, more efficient service) is to make the expert vendor the key. The only reason a client is outsourcing a service is that they do not have the expertise in-house or there is another organization with greater expertise. Since the client doesn’t have the expertise, it only makes sense that they wouldn’t try to manage, direct, and control expert vendors either. The most efficient thing to do would be for the client to utilize an expert’s expertise and let them determine what, how and when the service should be delivered, and identify what they need from the client and all other stakeholders. This is not what usually happens. In fact, over 25 years of industry research has identified that 90% of all risk on projects is caused by the client (PBSRG, 2020).

Most organizations end up receiving a low-quality service at a high cost. This is because they have a Client Centric approach.

The Client Centric Approach

What is a client centric approach? It is an approach where someone other than the expert vendor is making decisions and managing the project. It is when more importance is placed on the client and its representatives than the expert vendor. This type of approach requires stakeholders to do more work. They have to do more planning, lengthier procurements, and more management of vendors throughout the project.

Here are some signs that your organization has a client centric approach when delivering services:

-

- It spends a lot of time researching and developing a service/project before an expert vendor is hired to perform the service/project.

- When procuring a service, the scope of work is longer than one page.

- During procurement, the client’s representatives and stakeholders decide which vendor should be selected, instead of the letting the vendor’s performance identify they are the best for the job.

- The client project manager or another stakeholder is making decisions and managing, directing, and controlling the project (the expert vendor is not in charge).

Here are some characteristics of a client centric approach:

-

- Increased passing of technical information

- Increased communication

- Lots of meetings

- Large client project team

- Increased collaboration

- No plan from beginning to end

- No performance metrics being tracked

When using a client centric model, the client and stakeholders spend time and resources in the development, procurement, and execution phases. This greatly increases the cost of the service/project. This is the main reason why project performance is suffering. However, if a vendor centric approach was being used, the cost would be minimized by up to 30% and the client would receive high performance.

The Vendor Centric Approach

What is a Vendor Centric approach? It is an approach where the expert vendor does the majority of the work to develop a plan and execute a service/project. The expert vendor is in complete control of the project.

What is a Vendor Centric approach? It is an approach where the expert vendor does the majority of the work to develop a plan and execute a service/project. The expert vendor is in complete control of the project.

Here are some indicators that your organization is running a vendor centric approach:

-

- You spend very little time developing a project. You don’t issue RFIs (Request for Information). You identify high-level objectives and then you move to procure an expert.

- You don’t communicate very much during procurement. This means less talking, writing, discussion, emails, etc. Thus, your scope of work in your RFP (Request for Proposal) is short and not detailed, your meetings are short, and there is not a lot of discussion and talking. There are few emails being sent out as well.

- You have a small client team and the team does not do very much for the project. Larger client teams do more work, make more decisions, and exert more control. Bigger teams take work away from vendors, make vendors less accountable, and disregard vendor expertise.

- The vendor creates the technical scope of the project/service. The only way the client can truly utilize the expertise of the vendor is if they have the vendor create the technical scope of the project. This should be the same scope that goes in the contract.

- During execution of a project, there is no management of the vendor. In fact, the only thing a client does is help the vendor as needed. In other words, the client is taking directions from the vendor.

In a perfect vendor centric approach, the client will spend almost no effort on a project/service. It takes very little effort to hire an expert vendor and sign a contract. The client does not need to have an experienced project manager and will not need to hire consultants to help them deliver a service. They will only need to hire the expert vendor and let them do the work. It will be quick, easy, and take almost no resources (except for what is required to pay the expert vendor).

To do this, you would need a delivery model that can do the following:

-

- Be able to procure a project without knowing the exact requirements and details of what the owner wants.

- Have a simple, quick, easy procurement process that always hires the most expert vendor for the lowest cost.

- Have a way to ensure the client always gets what they want, and can verify this before they sign a contract.

- Have a way to make sure the vendor is accountable for the performance of the contract.

After 28 years of research, we have only found one model that achieves each of these objectives: the Best Value Approach.

The Best Value Approach

The Best Value Approach has been developed over the last 30 years. It first began its testing at Arizona State University in the 1990s by Dr. Dean Kashiwagi. Today, research on the BVA is still being done by the Kashiwagi Solution Model and the Performance Based Studies Research Group. From numerous PhD studies (Kashiwagi, 2013; Rivera, 2017; Le, 2019; Chen, 2020) it has been found to be the only delivery model that has documentation on multiple projects that it can increase efficiency and improve performance on projects. It also happens to be the most vendor centric approach currently being used. The performance of the system is as follows (Duren & Doree, 2008; D. Kashiwagi & J. Kashiwagi, 2019; Kashiwagi, 2014b; Rivera, 2014; State of Hawaii PIPS Advisory Committee, 2002):

The Best Value Approach has been developed over the last 30 years. It first began its testing at Arizona State University in the 1990s by Dr. Dean Kashiwagi. Today, research on the BVA is still being done by the Kashiwagi Solution Model and the Performance Based Studies Research Group. From numerous PhD studies (Kashiwagi, 2013; Rivera, 2017; Le, 2019; Chen, 2020) it has been found to be the only delivery model that has documentation on multiple projects that it can increase efficiency and improve performance on projects. It also happens to be the most vendor centric approach currently being used. The performance of the system is as follows (Duren & Doree, 2008; D. Kashiwagi & J. Kashiwagi, 2019; Kashiwagi, 2014b; Rivera, 2014; State of Hawaii PIPS Advisory Committee, 2002):

-

- IP included: Performance Information Procurement System (PIPS), Performance Information Risk Management System (PIRMS), Best Value Approach (BVA).

- Research areas include information based and automated project management, information-based risk management, supply chain optimization, language of metrics, vendor performance metrics and the Best Value Approach (BVA).

- Prototype Testing: 2,000+ tests with industry, ten different countries, $6.6B of services delivered [construction, IT, consulting services].

- Industry research tests measure 98% client satisfaction, minimized cost [5 – 50%], and minimized contractor time and cost deviation to less than 1%.

- 350 refereed journal papers, conference publications and books.

- Research Funding: $17.6M [industry visionaries and not government research funding]

- Licensed Intellectual Property (IP): 64 licenses [1997 – 2020] [most licensed IP technology at Arizona State University].

- Integrated PBSRG with the CIB [International Council of Research and Innovation in Building and Construction] working commission W117 “Use of Performance Information in the Construction Industry” in 2008.

- Director moved PBSRG, to the private sector in 2017, then moved the academic research to the SKEMA Business School Project Management dBA program [Doctor of Business Administration] in 2019.

The BVA has been audited four times to verify its performance, and each study found the information to be accurate (COE PARC, 2008; Duren & Doree, 2008; Kashiwagi et al. 2002; State of Hawaii Report 2002 (DISD); Rijt & Santema, 2013; WSCA/NASPO Agreement, 2011; Zuyd University & University Twente, 2008).

To learn more about the BVA approach and how to save up to 30% on your purchases and increase your efficiency, visit one of our links below:

-

- Connect with Dr. Dean on LinkedIn

- Subscribe to our YouTube channel

- Attend our Annual Conference

- Read publications in our latest journal

- Email us with questions

- Purchase books on BVA

References

CII (2015). Performance Assessment 2015 Edition. Construction Industry Institute. Web. (2015). Retrieved from http://www. Construction-institute.org/performance.

Duren, J., & Dorée, A. (2008, August). An evaluation of performance information procurement system (PIPS). 3rd international IPPC conference, Amsterdam.

IHS Markit (2013). Public Annual Reports; press releases. IHS Herold Global Projects Database. Retrieved from: http://www.herold.com/research/industry_research.home

Kashiwagi, D.T. and Savicky, J. (2002) “Resistance to Best Value Procurement in the Construction Industry” W65 – CIB 2002 10th International Symposium; Cincinnati, OH; Vol. 2, pp. 788-798 (September 10, 2002).

Kashiwagi, D. (2014). Best value standard. Performance Based Studies Research Group. Tempe, Az. Publisher: KSM Inc.

Kashiwagi, D. (2019). The Information Measurement Theory Story. (I. Kashiwagi, J. Kashiwagi, & J. Kashiwagi, Eds.). Mesa: Kashiwagi Solution Model Inc.

Kashiwagi, D., & Kashiwagi, J. (2019). W117 Performance Information in Construction: Summer 2019 Research Roadmap. Journal for the Advancement of Performance Information and Value, 11 (1), 10-20.

PBSRG (2020). Performance Based Studies Research Group. Documented raw data information, Mesa, AZ. Retrieved from PBSRG Web site: pbsrg.com

Rivera, A. (2017). Dissertation, Ph.D. Shifting from Management to Leadership: A Procurement Model Adaptation to Project Management. Arizona State University.

Rivera, A. (2014). Impact of a Non-Traditional Research Approach Case Study on the Performance Based Studies Research Group (PBSRG). Arizona State University.

State of Hawaii PIPS Advisory Committee (2002) Report for Senate Concurrent Resolution No. 39 Requesting a Review of the Performance Information Procurement System (PIPS), Honolulu, HI: U.S. Government, Available from: http://ags.hawaii.gov/wp-content/uploads/2012/09/pips.pdf.